Maximize Your Sale with an Exit Assessment for Selling Your Business

Introduction

Selling a business is one of the most significant decisions an entrepreneur can make. Whether you're retiring, moving to a new venture, or simply cashing in on years of hard work, ensuring your business is ready for sale is critical. One of the most powerful tools in this process is the exit assessment—a strategic evaluation designed to enhance transparency, identify risks, and maximize the final sale price. By proactively addressing issues and showcasing strengths, you can enter negotiations with confidence and clarity.

The Role of Exit Assessments in Business Sales

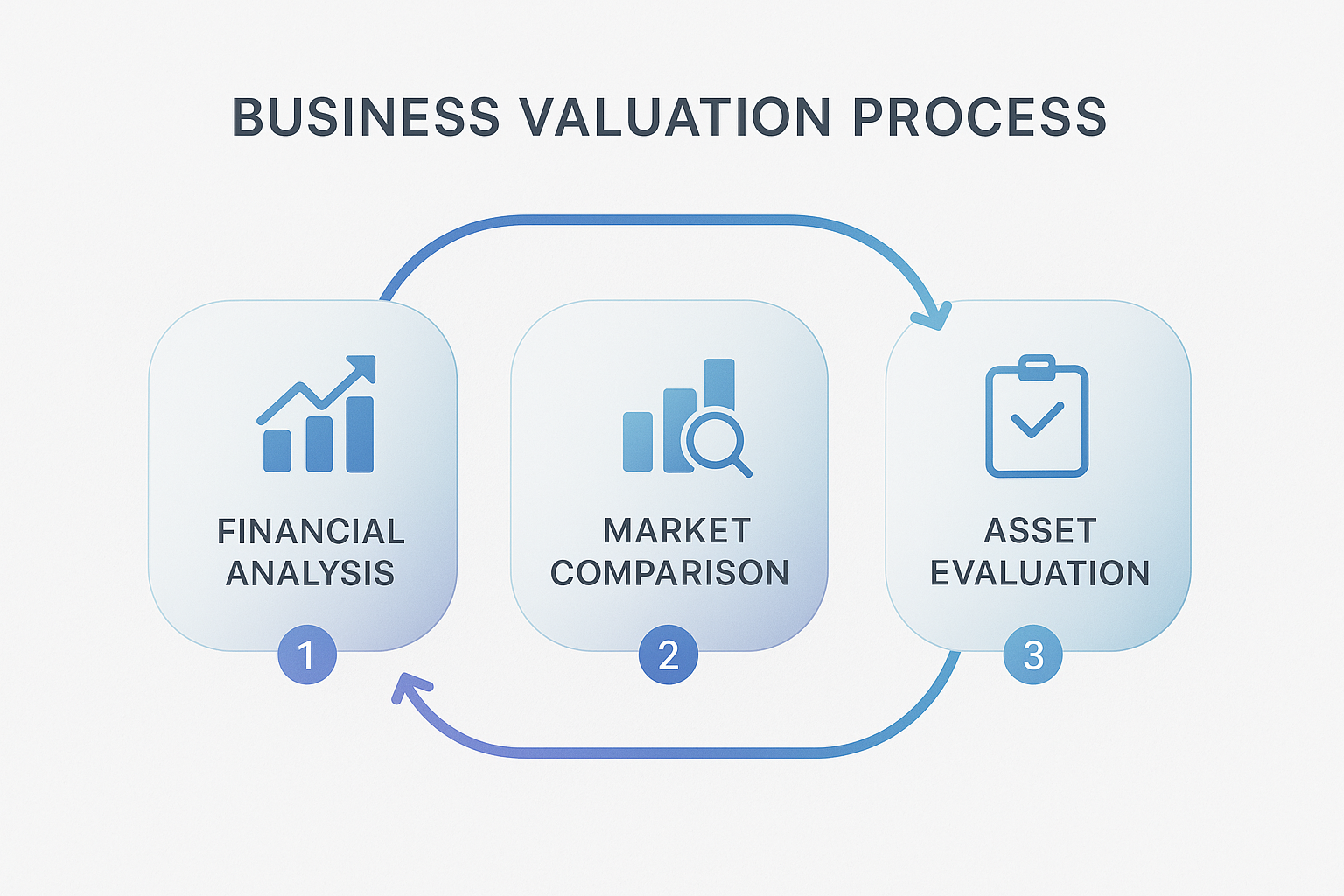

An exit assessment in the context of selling a business is a comprehensive review of every facet of the company to determine its readiness for sale. It goes beyond a simple valuation—it uncovers operational inefficiencies, legal risks, and financial inconsistencies that could jeopardize a deal.

Buyers conduct due diligence to uncover potential red flags, and your exit assessment allows you to anticipate these findings. It also demonstrates professionalism and preparedness, which can increase buyer trust and lead to a faster, smoother sale. Think of it as an internal audit with the aim of maximizing your leverage in the negotiation process.

Core Areas to Evaluate Before Selling

A high-quality exit assessment covers several key areas, each of which contributes to your business’s perceived value:

Financial Records: Ensure profit and loss statements, balance sheets, and tax filings are accurate, organized, and reflective of true performance. Debt, cash flow trends, and revenue consistency are critical areas of focus.

Organizational Structure: Evaluate your team, including leadership stability, staffing levels, and roles. Succession planning and documented processes increase buyer confidence.

Legal and Intellectual Property: Review contracts, licenses, intellectual property (IP) protections, and regulatory compliance. Pending legal issues or unclear IP rights can significantly reduce a buyer’s interest.

Customer Base and Market Position: Analyze customer retention, acquisition costs, lifetime value, and how your business compares to competitors. Strong brand equity and loyal customers are major selling points.

Operational Systems: Consider the scalability, efficiency, and automation of your systems. Businesses with documented, repeatable operations are much more appealing to buyers.

Preparing for a Smooth Sale

Preparation is key. Once the assessment identifies strengths and weaknesses, you can begin organizing a due diligence file. This includes:

Verified financial reports and projections

Updated contracts and employee agreements

Detailed operational procedures

Intellectual property documents

A clean cap table and ownership records

Address operational bottlenecks and document all improvements. Craft a compelling executive summary that highlights your value proposition, market opportunity, and potential for growth—this becomes your pitch document for serious buyers.

Professional Help: Who Should Be on Your Team

You don’t have to do it alone. Assembling the right team of professionals can significantly improve your sale outcome:

Accountants: Ensure your financials are clean and credible.

Lawyers: Review contracts, legal risks, and compliance issues.

Business Brokers: Provide market insight, connect you with buyers, and negotiate terms.

Valuation Experts: Offer a realistic market-based valuation.

Consultants: Pinpoint gaps and enhance operations for a better presentation.

Their expertise not only saves time but also ensures you don’t overlook critical areas that could affect your valuation or delay the sale.

Case Studies: Lessons from the Marketplace

Consider two real-world examples:

Success: A software company undergoing a thorough exit assessment discovered redundant expenses and streamlined operations before listing. This increased EBITDA by 15%, attracting multiple offers and resulting in a sale 20% above initial valuation.

Failure: A retail business neglected to resolve tax inconsistencies and lacked clear ownership documentation. Buyers pulled out after due diligence, and the deal collapsed—costing the owner months of time and legal fees.

These examples highlight how exit assessments can make or break a deal. Preparedness pays off.

Final Tips to Maximize Exit Value

Here are actionable strategies to help you close the best deal:

Time It Right: Sell when market conditions are favorable, and financial performance is strong.

Fix What You Can: Address obvious operational or financial issues before buyers find them.

Be Transparent: Share clear, honest information to build trust.

Show Growth Potential: Highlight scalable systems and untapped opportunities.

Negotiate with Facts: Use well-documented data from your assessment to defend your asking price.

By following these steps, you enhance not only the sale price but also your reputation and long-term business legacy.

Conclusion

An exit assessment for selling your business isn’t just a formality—it’s a powerful strategy to elevate your business’s value, reduce transaction friction, and ensure a successful sale. By identifying strengths, addressing weaknesses, and preparing documentation in advance, you position yourself for optimal results. With the right team and a clear plan, your business sale can be a rewarding conclusion to your entrepreneurial journey.