IPO Exit Advisory Explained: What Every Founder Needs to Know

I. Introduction

Going public through an Initial Public Offering (IPO) marks a transformative phase in a startup’s lifecycle. For founders, it symbolizes both the culmination of years of effort and the gateway to scaling on a much larger stage. However, the journey to an IPO is complex, laden with legal, financial, and strategic hurdles that most entrepreneurs are not equipped to handle alone. This is where IPO exit advisory comes into play. These advisory services offer specialized guidance, ensuring that businesses are fully prepared for a successful public debut. Whether you're in early growth or late-stage funding, understanding how IPO advisory works is crucial to navigating this pivotal transition.

II. IPO Exit Strategy: An Overview

An IPO exit strategy refers to the planned process by which a private company transitions to a publicly traded one, offering shares to the public in a regulated market. Unlike private exits like acquisitions, IPOs involve greater scrutiny, disclosure, and stakeholder involvement. Key players in this process include founders, board members, investment banks, legal teams, and advisory firms. Without expert support, founders can find themselves overwhelmed by regulatory filings, valuation issues, and timing decisions. An effective strategy incorporates market readiness, internal alignment, and clear objectives, making the role of IPO exit advisors not just helpful but essential.

III. The Role of IPO Exit Advisors

IPO exit advisors serve as strategic partners during this critical stage. Their responsibilities span across multiple domains:

Strategic Insights: Advisors help founders craft compelling equity stories that resonate with investors and meet market expectations.

Legal and Compliance Navigation: They assist with SEC filings, disclosure requirements, and ensuring the company meets all regulatory standards.

Financial Readiness: Advisors evaluate the company’s financial health and prepare it for scrutiny by analysts and institutional investors.

Team Coordination: They act as a bridge between legal, financial, and operational stakeholders to maintain momentum and focus.

Investor Communication: These advisors shape communication strategies to engage investors with transparency and confidence.

Without such comprehensive support, the risk of regulatory missteps and investor misalignment increases dramatically.

IV. Timing Your IPO Exit

Choosing the right time for your IPO is as important as the decision to go public itself. Market conditions—like interest rates, investor appetite, and economic trends—can significantly influence IPO success. Internally, companies need to evaluate performance benchmarks such as consistent revenue growth, profitability potential, and operational stability. A good IPO exit advisor will help assess these metrics alongside external trends to find the optimal launch window. They also help build flexibility into the timeline to accommodate sudden market shifts or strategic pivots. Timing isn’t just about being ready—it’s about being right on time.

V. How Advisory Services Impact Outcomes

Working with IPO advisory services can profoundly shape the final outcome of an IPO. Founders often report:

Higher Valuations: Advisors fine-tune the equity narrative and financial presentations to reflect the company’s true market potential.

Reduced Risk: Compliance and legal guidance significantly decrease the chances of costly errors or delays.

Greater Investor Confidence: A well-managed IPO process signals professionalism and reliability, attracting more interest.

Better Deal Terms: With advisory input, founders can negotiate more favorable terms regarding share pricing and investor composition.

Post-IPO Stability: Companies with strong advisory support often show better performance and governance after listing.

The ripple effects of solid advisory support are felt long after the initial public offering.

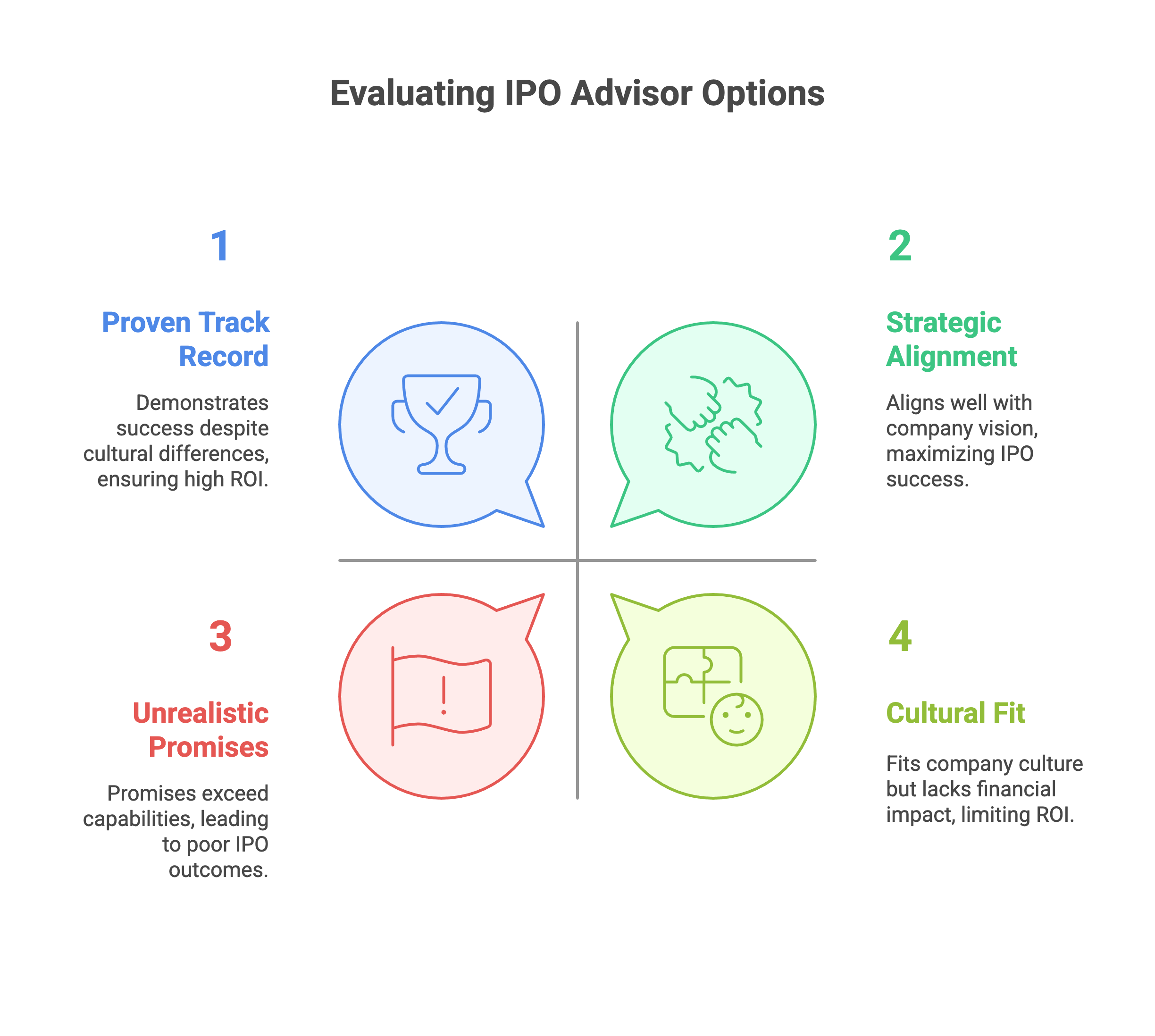

VI. Evaluating and Selecting an Advisor

Not all IPO advisors are created equal. When evaluating your options:

Check Credentials: Look for advisors with a proven track record in your industry and successful IPOs under their belt.

Ask Strategic Questions: Understand how they approach valuation, investor relations, and crisis management.

Watch for Red Flags: Avoid advisors who promise unrealistic timelines or lack regulatory knowledge.

Assess Compatibility: Choose someone who aligns with your company culture and long-term vision.

Evaluate ROI: Consider the cost of advisory services against the value they can add to your IPO’s success.

Founders should treat this decision with the same rigor as selecting a co-founder or C-level executive.

VII. Case Study: A Successful IPO with Advisory Support

Take the example of a mid-sized SaaS company preparing for an IPO. Initially, they struggled with inconsistent financial reporting and poor investor messaging. Upon engaging an IPO exit advisor, they underwent a full strategic overhaul. Financial statements were revised, legal gaps closed, and investor decks restructured. Within 12 months, the company not only went public but exceeded valuation expectations by 25%, attracting blue-chip investors. This success was largely attributed to the structured, expert-led process their advisor provided.

VIII. Conclusion and Key Takeaways

The IPO journey is a marathon, not a sprint—and founders shouldn’t run it alone. From regulatory complexities to investor engagement, IPO exit advisory fills a critical void in the transition from private to public. By engaging experts early, crafting a smart timing strategy, and selecting the right advisory partner, founders can ensure they don’t just go public—they thrive in the public arena. The road to IPO is challenging, but with the right guidance, it can also be extraordinarily rewarding.

FAQ

What is IPO exit advisory?

IPO exit advisory involves professional guidance during a company’s transition to becoming publicly traded, helping with strategy, compliance, and investor relations.When should a startup engage an IPO advisor?

Ideally, 12–18 months before the intended IPO date to allow ample time for readiness assessments and strategic alignment.Do all companies need IPO advisors?

While not legally required, advisors dramatically improve outcomes, reduce risk, and enhance investor confidence.How much do IPO advisory services cost?

Costs vary but often include a combination of fixed fees and success-based incentives. ROI tends to justify the expense.What’s the difference between an IPO advisor and an investment bank?

Advisors focus on holistic preparation and strategy, while investment banks handle underwriting and share issuance.